MoonFox Data | Simultaneous Growth in Scale and Profit of Ly.com Underscores the Potential of Mass-market Tourism

Shenzhen, June 26, 2025 (GLOBE NEWSWIRE) -- MoonFox Data | Simultaneous Growth in Scale and Profit of Ly.com Underscores the Potential of Mass-market Tourism

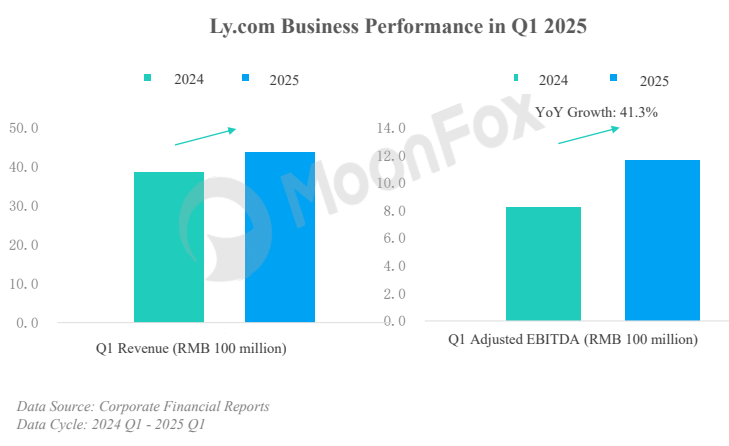

In Q1 2025, ly.com reported revenue of RMB 4.377 billion and adjusted net profit of RMB 788 million, marking YoY increases of 13.2% and 41.1%, respectively. Amid a macro recovery marked by YoY growth in both travel volume and consumer spending, ly.com has tapped into the tourism potential of non-first-tier markets, demonstrating strong demand beyond first-tier cities. While consolidating its core OTA business, the company has expanded into air tickets, hotels, and international operations, achieving diversified growth. By integrating AI strategies to drive cost reduction and efficiency, it is accelerating technological transformation and showcasing long-term growth resilience. Looking ahead, the mass-market tourism sector presents substantial upside potential. OTA platforms that can deliver both inclusive accessibility and elevated service quality are well-positioned to capitalize on structural opportunities within the industry.

I. Operational Performance: Revenue and Profit Growth Driven by Multi-dimensional Expansion and Optimized Business Mix

In Q1, ly.com reported revenue of RMB 4.377 billion, increased by 13.2% YoY. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) reached RMB 1.159 billion, while adjusted net profit rose to RMB 788 million, both growing by over 41% YoY. From a business segment perspective, ly.com's growth is primarily driven by its core services such as accommodation booking and transportation ticketing, along with the expansion of other emerging businesses. This has enabled the company to build a synergistic model of "transportation + accommodation + vacation" and "domestic + international" operations, leading to a more balanced and healthier business structure.

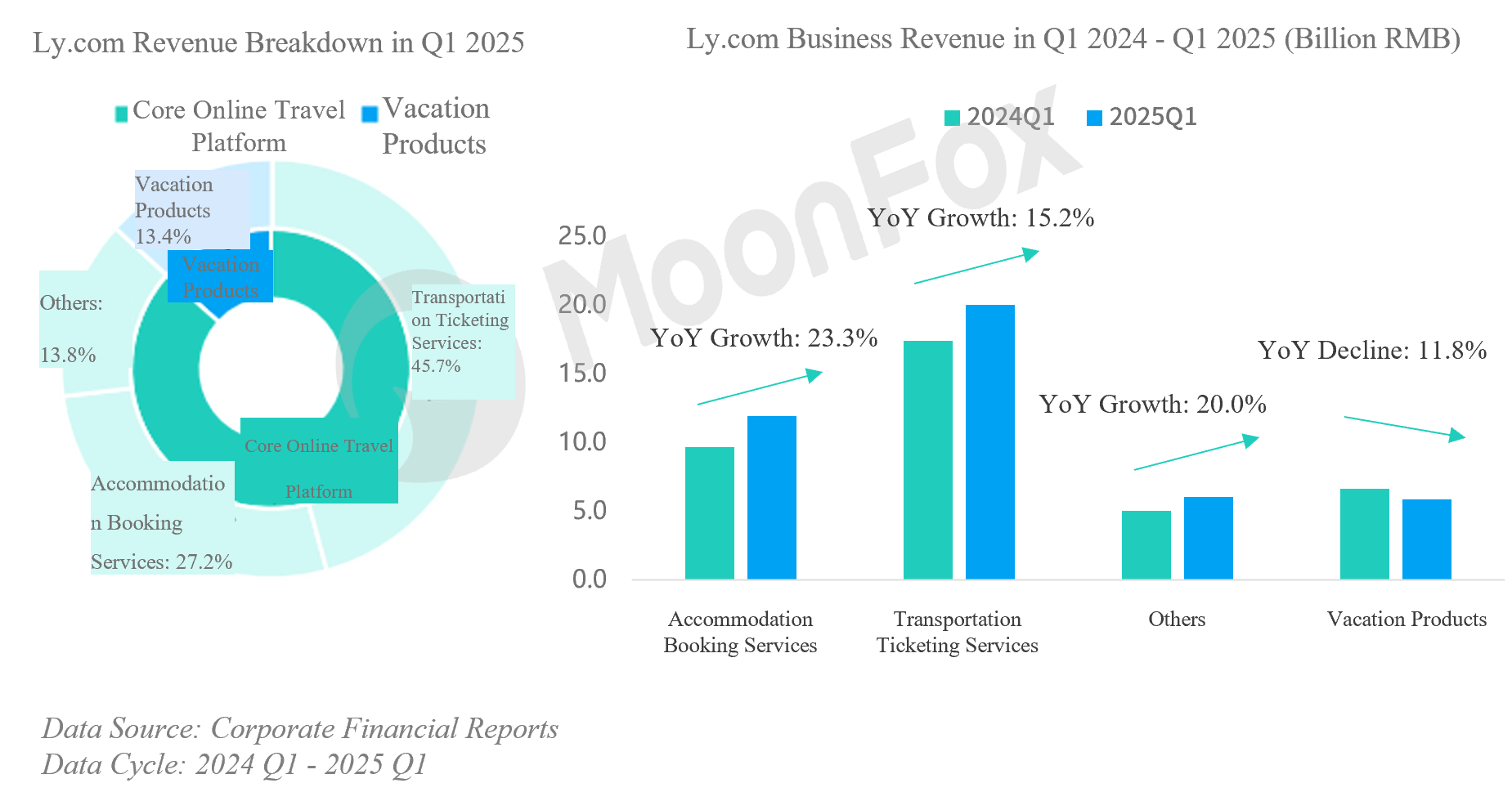

1. OTA remains the core revenue driver with significant growth: In Q1, revenue from ly.com's online travel platform segment grew by 18.4% YoY to RMB 3.792 billion, accounting for approximately 86.6% of total revenue. Among these, accommodation booking services led with a YoY growth rate of 23.3%, while transportation ticketing revenue also rose by 15.2% YoY. This growth was mainly driven by ly.com's continued efforts in Q1 to diversify and innovate value-added products for flights and hotels, enhance end-to-end service capabilities for mass-market travel, and attract users through strong promotional offers, effectively capturing demand arising from the broader macroeconomic recovery. For instance, multi-section transfer products like "train-to-train" and "air-to-air" connections offered competitive and cost-effective travel solutions, resulting in YoY booking increases of 22% and 44%, respectively.

2. Diversified revenue streams expand, though vacation business sees a dip: Other revenues rose 20% YoY in Q1 to RMB 603 million, driven by growth in hotel management services and Property Management System (PMS) operations, emerging as a meaningful contributor to ly.com's top line. At the macro level, the development and upgrading of mass tourism have driven growing demand for leisure travel, with vacationing becoming a preferred choice for more travelers. Ly.com has responded by launching scenario-based innovations such as small-group and customized tours, effectively unlocking users' leisure and holiday needs. However, due to safety concerns in Southeast Asia, vacation-related revenue declined by 11.8% YoY in Q1.

3. Outbound travel drives performance with strong momentum: In recent years, ly.com has consistently expanded its international business by introducing airport transfer services abroad, launching an international travel booking platform and localized apps, establishing overseas physical stores and customer experience centers, and partnering with global airlines and hotels. These efforts aim to seize the growth opportunities in outbound tourism and enhance the company's penetration rate in overseas markets. According to the financial report, in Q1 2025, driven by a surge in outbound travel among users from non-first-tier cities, ly.com recorded a YoY increase of over 40% in international air ticket bookings and over 50% in international hotel room nights. Looking ahead, the deeper penetration of outbound travel services in non-first-tier markets is expected to make international air, hotel, and vacation businesses a new engine for driving performance growth.

II. Business Developments: Focusing on Mass-market Tourism Consumption Demand and Accelerating AI Capabilities

1. Deepening Commitment To Mass-market Tourism To Build Scale and Amplify User Value

With a strategic focus on the mass-market tourism sector, ly.com targets consumers in non-first-tier cities, an audience with vast growth potential. By leveraging high-frequency UV entrances, offering one-stop services across full travel scenarios, and delivering cost-effective products to match the mass-market tourism consumption demand, the company continues to expand its user base and enhance user value. According to its financial report, as of the end of Q1 2025, ly.com had served a cumulative 1.96 billion trips and reached 247 million paying users, both representing over 7% YoY growth. Notably, users from non-first-tier cities accounted for 87% of total registered users, highlighting the success of its penetration strategy in markets in lower-tier cities.

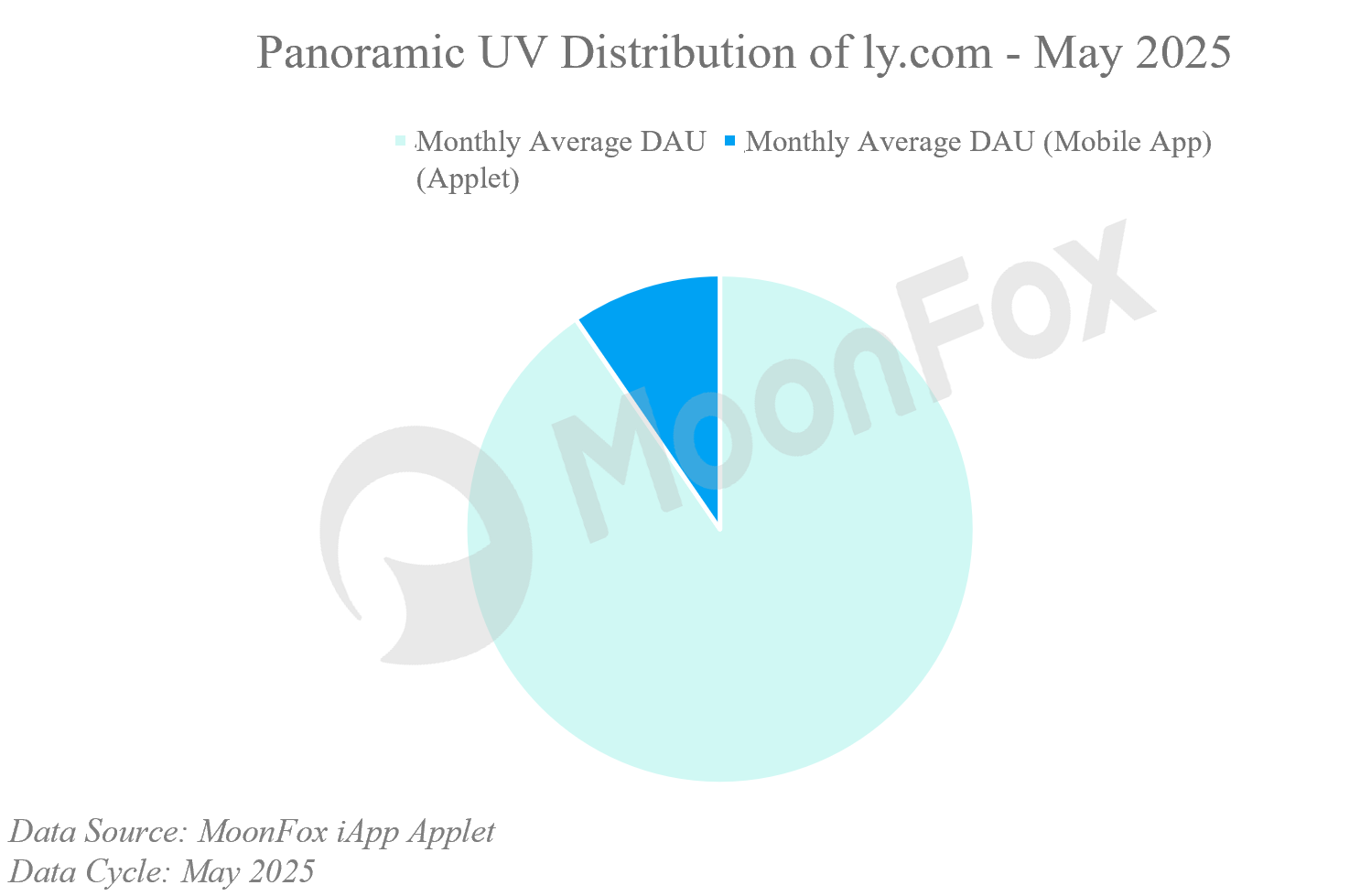

① UV entrances and service scenarios aligned with mass-market tourism consumers: In addition to its proprietary app, ly.com has embedded itself deeply into the WeChat ecosystem, using lightweight applets and high-frequency ticketing demands to reach consumers, to form stable UVs and further penetrate the markets in lower-tier cities. In Q1, ly.com continued to optimize operational efficiency within WeChat ecosystem; Between January and April, its "City Pass" WeChat applet expanded into Beijing and Guangzhou, covering urban transit scenarios. Through applet channels and City Pass business integration, ly.com further diversified its UV entrances and ecosystem touchpoints. According to MoonFox Data, WeChat applets maintain a leading share within ly.com's overall UV landscape.

② Supply chain integration enhances one-stop & cost-effective offerings: Through upstream and downstream supply chain integration, ly.com has extended its reach across the entire travel ecosystem, leveraging innovation and synergy to drive user engagement. By continuously enriching its "Air Travel +" product portfolio, the company has expanded its service coverage and strengthened price competitiveness to boost user spending and repeat purchases. In Q1 2025, ly.com partnered with multiple global airlines, airports, and international hotel groups such as Marriott and Hilton, further building its supply chain advantage in outbound tourism and helping reduce travel costs for users. On April 17, ly.com announced the acquisition of 100% equity in Wanda Hotel Management Co. Limited. The move is expected to "complement" its high-end hotel brand portfolio through Wanda's brand matrix and resource base, enhancing its competitiveness in the hotel management sector.

③ Inclusive services and membership program drive user retention: In January 2025, ly.com partnered with several domestic airports to launch the "Worry-free First Trip" initiative, which officially rolled out to all users in mid-March. Designed to reduce travel barriers for elderly, students, and foreign travelers, the program supports new user acquisition and paid user growth. Meanwhile, the company upgraded its Black Card membership system, adding over 50 new benefits such as free hotel cancellation/modification and full-point redemption for room bookings. These enhancements are intended to boost loyalty among high-value users and better meet the rising demand for premium travel from non-first-tier markets, capitalizing on the consumption upgrade trend in mass-market tourism.

2. Deep Integration with DeepSeek to Advance AI-Powered Efficiency and Experience

On February 28, ly.com announced that its proprietary large vertical large model for the travel industry, "Chengxin", would be fully integrated with DeepSeek. In March, the company launched an upgraded version, Chengxin AI, alongside DeepTrip, an AI agent that delivers real-time travel planning and booking services. This intelligent system understands user intent, inspires travel ideas, and dynamically generates personalized itineraries and booking options, creating an intelligent one-stop service flow of "travel need → personalized plan → product consumption". Since its launch in December 2024, Chengxin AI has already served over 200,000 users. Its integration with DeepSeek is expected to further enhance user decision-making efficiency and elevate the smart travel experience. Looking ahead, ly.com plans to embed DeepTrip across its major booking scenarios, which is likely to increase the effectiveness of its cross-selling strategies.

AI also brings broader operational value. By leveraging AI technology, ly.com has reduced labor costs by 20% and significantly improved operational efficiency. On the B2B side, it exports AI capabilities via its intelligent hotel solutions, enabling hospitality partners to lower costs and expand digital empowerment boundaries.

III. Strategic Insights: Growth Trajectories for OTA Platforms Amid the "Mass Tourism" Trend

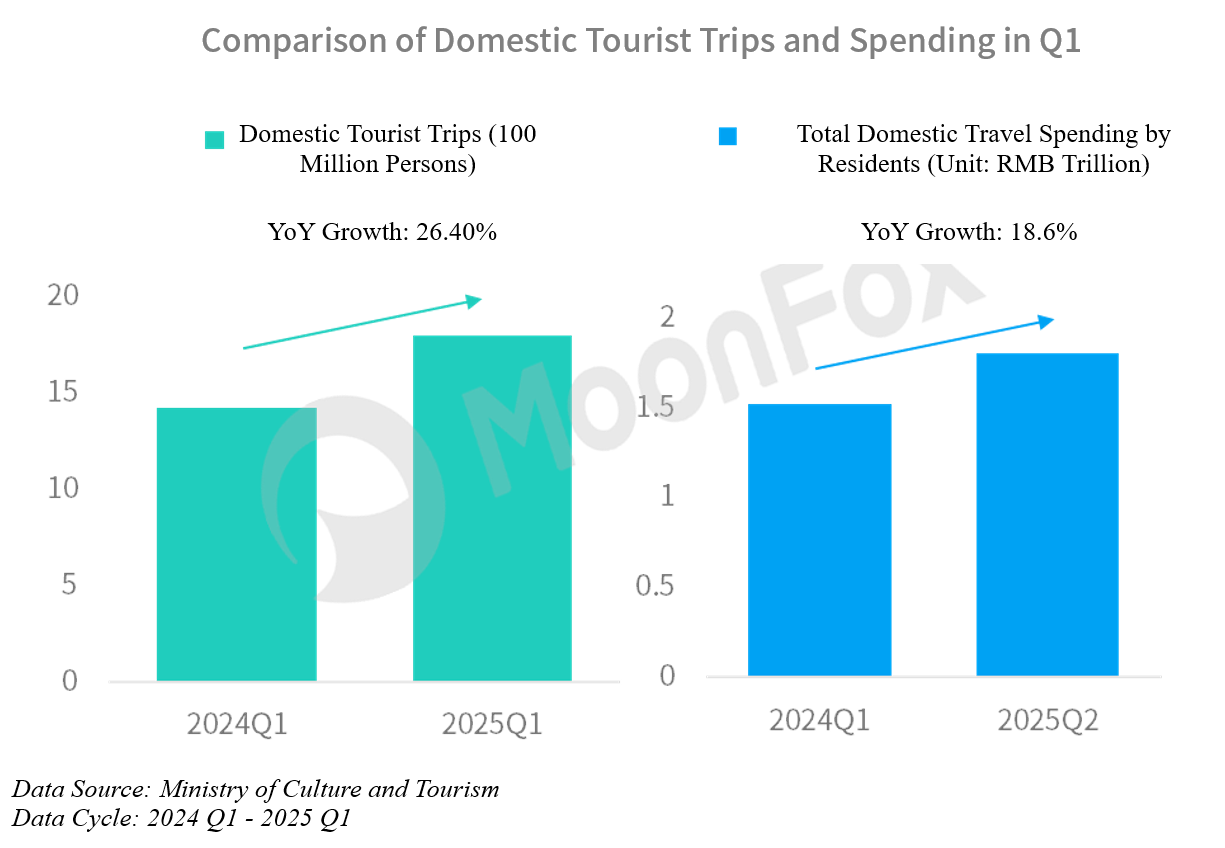

According to data from the Ministry of Culture and Tourism, domestic travel in China reached 1.794 billion trips in Q1 2025, with total travel-related spending hitting RMB 1.80 trillion, increased by 26.4% and 18.6% YoY, respectively. Residents in non-first-tier cities represent a massive consumer base, and with room to improve in both online OTA conversion rates and average revenue per user (ARPU), this demographic is expected to unleash long-term growth potential as travel frequency and spending power continue to rise, injecting both UVs and value into the industry.

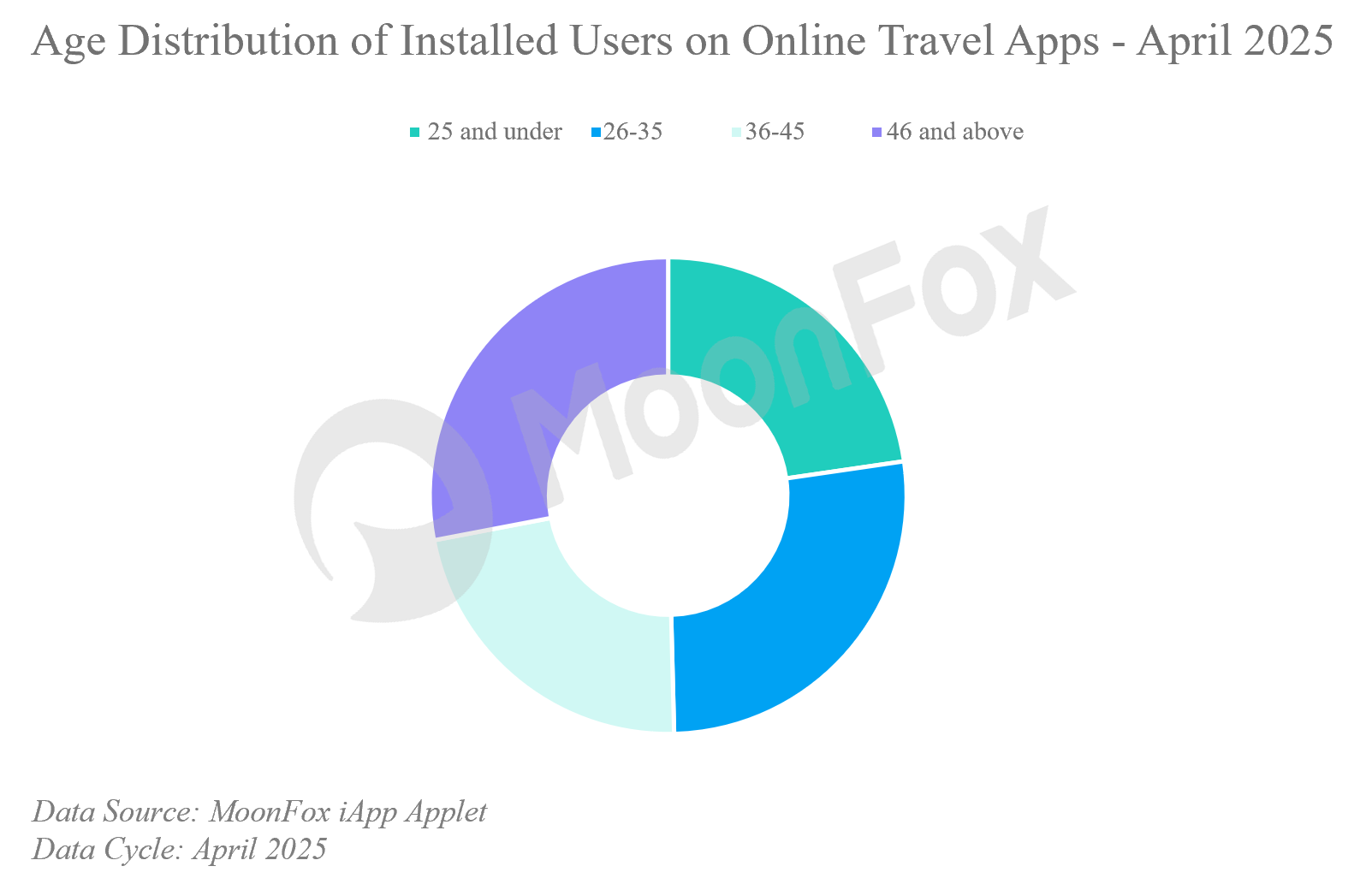

At present, mass-market tourism consumption is undergoing segmentation and diversification. A wide array of consumer groups is seeking differentiated, immersive travel experiences, where high quality and high cost-effectiveness coexist. In this context, OTA platforms must focus on customer segmentation and industry chain integration. According to iMarketing of MoonFox Data, as of April 2025, users aged 46 and above and those 25 years and younger accounted for 28% and 22.7%, respectively, of all installed users across online travel platform apps, making them key contributors to tourism consumption. To better serve these audiences, OTAs must develop differentiated services and content ecosystems that align with specific demographic preferences. For instance: Design elderly-friendly interfaces and develop wellness-themed travel products for older users. Partner in creating cultural tourism IPs and personalized itineraries, using short videos and live streaming to inspire younger travelers. On the product and service side, given mass-market consumers' dual demands for quality and affordability, OTA platforms should further integrate the supply chain, expanding their core inventory of accommodation and transport resources while strengthening pricing leverage. Bundled offerings such as premium air-hotel packages and county-level attraction combo passes can simultaneously enhance both product quality and perceived value.

In parallel, platforms should capitalize on surging outbound tourism. This includes proactive involvement in overseas destination marketing campaigns and a keen focus on the specific needs and pain points of outbound travelers from non-first-tier cities, an area poised for the next wave of growth. At the same time, leveraging advancements in large models, OTAs can embed AI technologies into real-world travel scenarios to drive long-term cost reduction, operational efficiency, and upgrades in user experience.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

For Media Inquiries:

Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en

Attachment

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.